ad valorem tax florida real estate

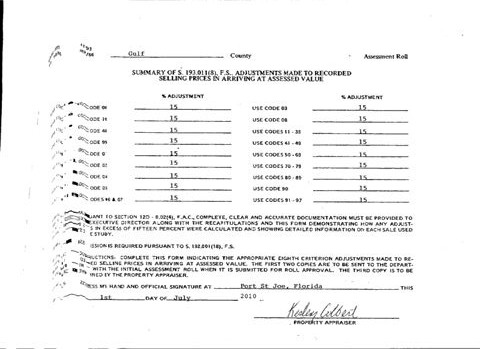

The millage rate is set by each ad valorem taxing authority for properties within their boundaries. Millage Rate is the rate of taxation.

Property Taxes How Much Are They In Different States Across The Us

0245 x 125000 3062 total tax for this property.

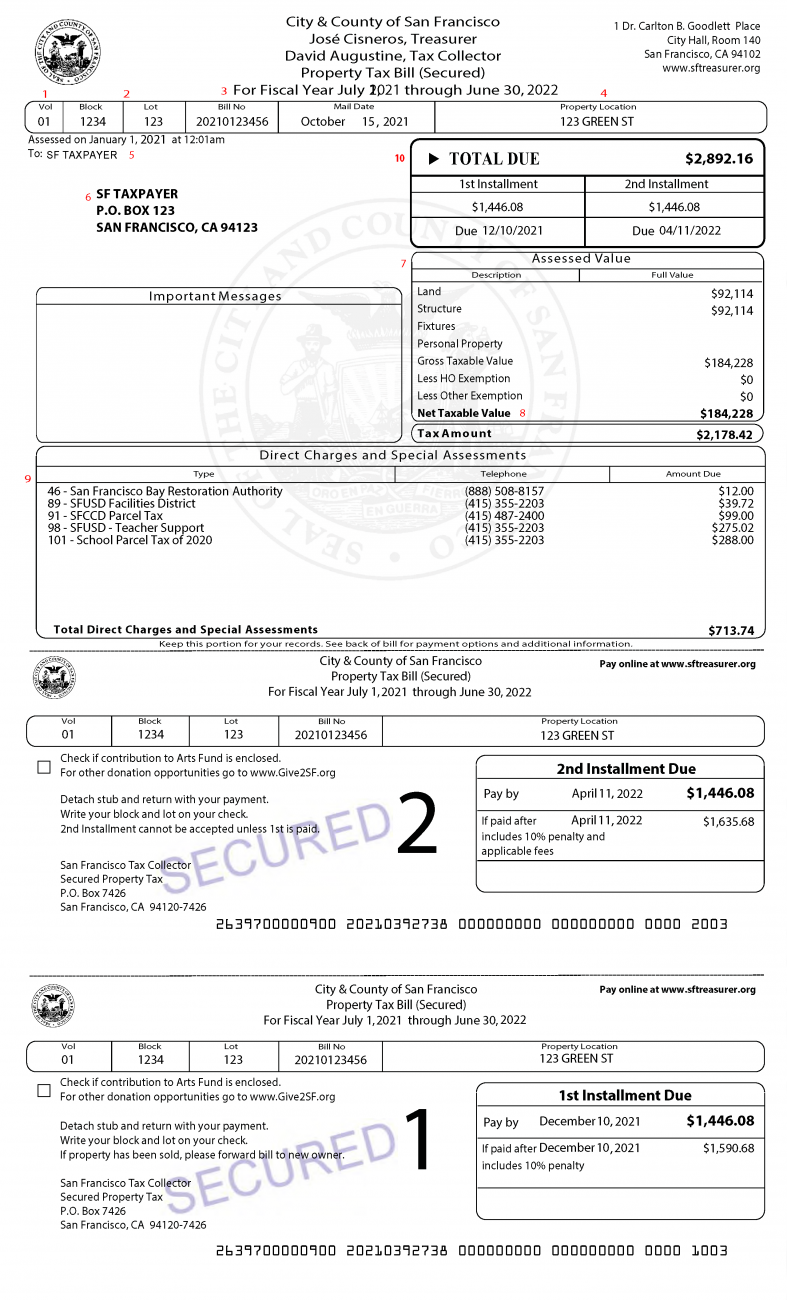

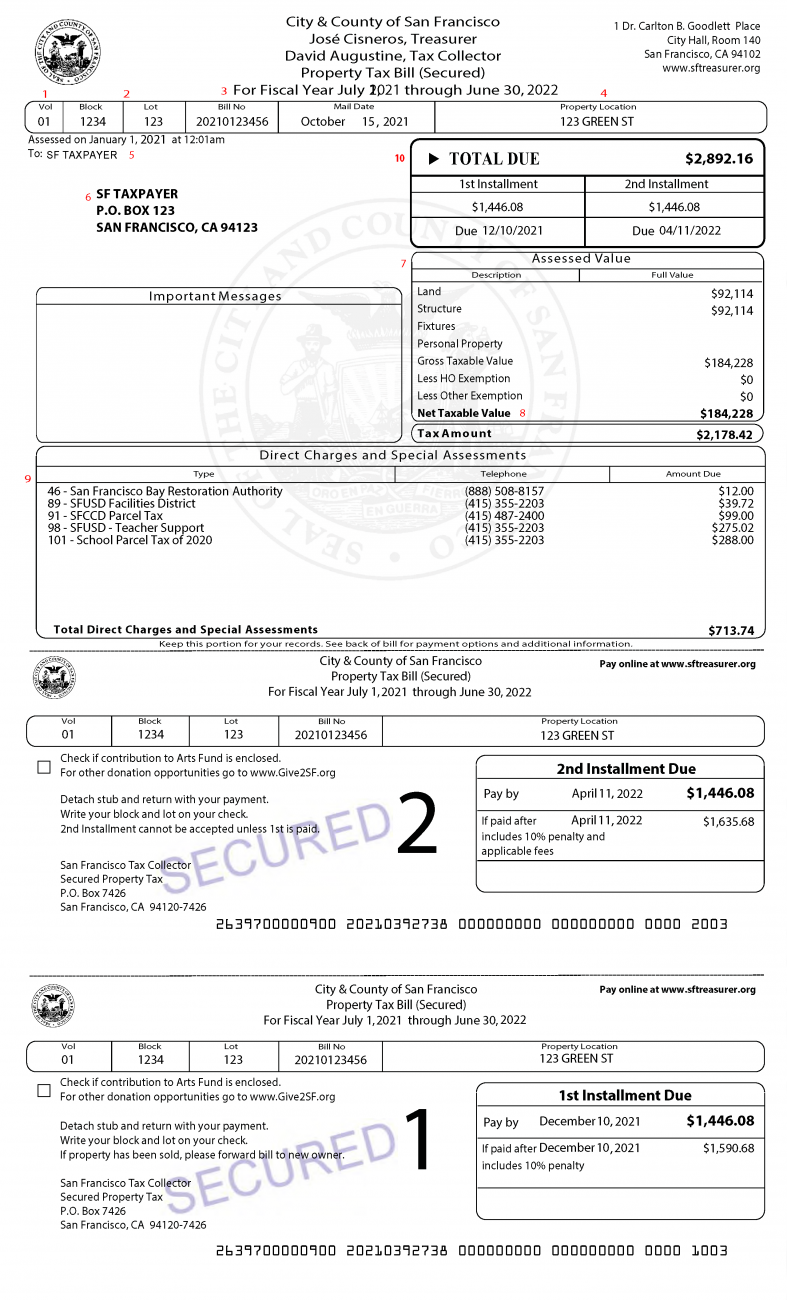

. It is the responsibility of each taxpayer to ensure that hisher taxes are paid and that a tax bill is received. They determine the ownership mailing address legal description and value of the property. The total of these two taxes equals your annual property tax amount.

The Property Appraiser establishes the taxable value of real estate property. Your propertys assessed value is determined by the Palm Beach County Property Appraiser. And we have non-ad valorem taxes which are based on other elements.

Real estate taxes comprise ad valorem taxes and non-ad valorem assessments while personal property taxes are solely ad valorem. Ad valorem taxes are added to the non-ad valorem assessments. Also known as ad valorem taxes real estate property taxes are based on the assessed value of a propertys land buildings and improvements determined by the Property Appraiser as of January 1.

The Property Appraisers Office establishes the assessed value of a property and prepares the tax roll. The taxes are calculated. Florida law divides property tax responsibilities between two separate agencies.

Ad Valorem Taxes are taxes levied on real property and calculated using the property value and approved millage rates. These taxes and assessments are sometimes assessed by their taxing authorities on different accounting periods. Under Florida Statute 197 the Tax Collector has the responsibility for the collection of ad valorem taxes and non-ad valorem taxes.

48-5-10 and is liable for the ad valorem taxes associated with that property. An ad valorem tax is a tax that is based on the assessed value of a property product or service. A tax of 18 mills typical of Duval County on a.

AD VALOREM TAXES. Florida real estate taxes often include different types of taxes and assessments. Non-Ad Valorem assessments such as streetlights sewage and road improvements are levied on a unit basis rather than the value of property.

This real estate ad valorem tax is sanctioned by local jurisdictions like counties or school districts. Tax Rates are Set. 4 if paid in November.

The most common ad valorem tax examples include property taxes on real estate sales tax on consumer goods and VAT on the value added to a final product or service. The most common and well-known ad valorem tax is the property tax levied on real estate properties. The most common ad valorem taxes are.

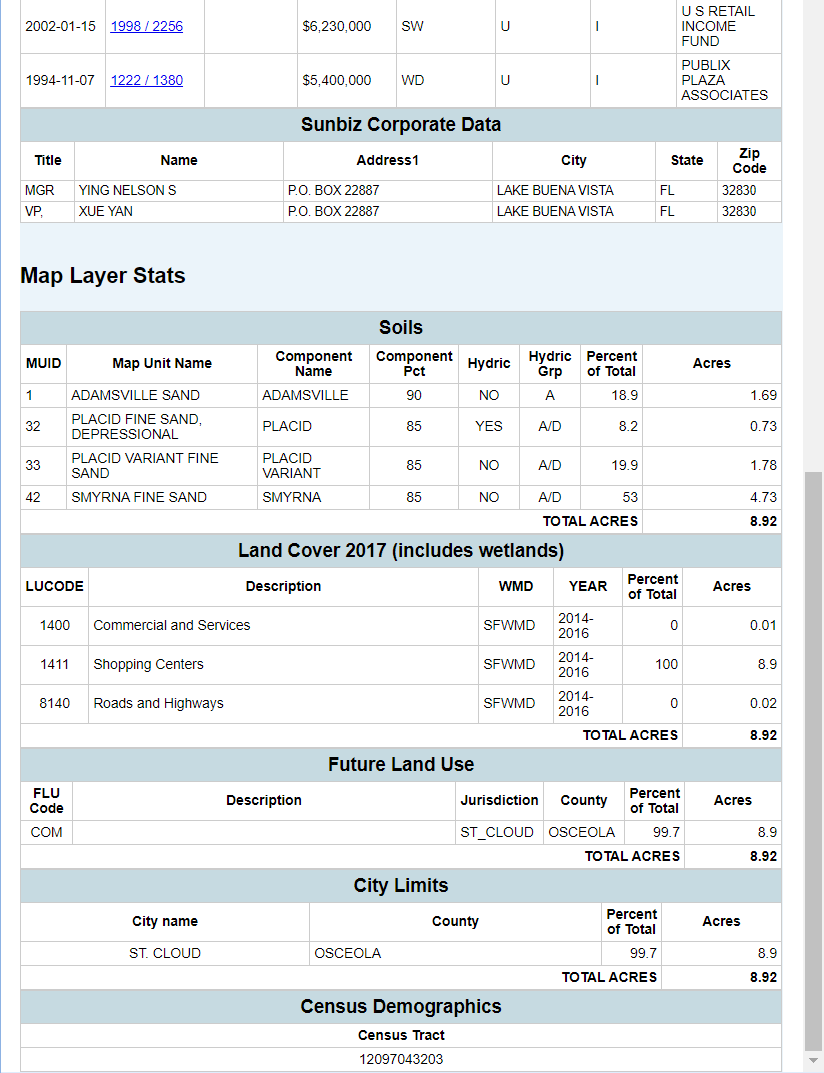

The Departments Florida Ad Valorem Valuation and Tax Data Book is a comprehensive summary of reported state- county- and municipal-level information regarding property value millages and taxes levied. Liability for ad valorem property taxes. There are two types of ad valorem property taxes in Florida which are Real Estate Property and Tangible Personal Property.

Assessed value is 150000- 25000 125000 taxable value. These taxes are based on the. Going from the Latin term translation ad valorem taxes are calculated according to the assets value.

At the end of the certified tax roll the Property Appraiser delivers the certified tax roll to the Tax Collector who mails tax notices to the last owner of the property to collect the money owed. A tax of one mill on 1000 of value is 100. A millage rate is one tenth of one percent which equates to 1 in taxes for every 1000 in home value.

Taxes are assessed by the Property Appraiser as of January 1 of each year and levied in Hillsborough County by the taxing authorities. These are levied by the county municipalities and various taxing authorities in the county. Ad valorem is a Latin phrase meaning according to worth.

Ad Valorem taxes on real property are collected by the Tax Collector on an annual basis beginning on November 1st for the year January through December. Tax notices are served to the owners last record of address or where the property owner pays through an escrow account and their mortgage company has requested to be sent the tax bill the owner will receive a copy. Ad valorem taxes or real property taxes are based on the value of such property and are paid in arrears.

For example we have ad valorem taxes which are based on the appraised value of the real property. Florida Ad Valorem Valuation and Tax Data Book. One mill is 11000 of a dollar which is 110 th of 1 cent.

Ad Valorem taxes are based on the assessed value and the millage of each taxing authority. Property 3549 2007 citing Ga. 1121 section 1961975 FS PDF 174 KB DR-504W.

The office of the Property Appraiser establishes the value of the property and the Board of County Commissioners School Board City Commissioners and other levying bodies set the millage rates. The most common way to apply ad. R 1-01-38-36-0020-00000-0360 REAL ESTATE TaxNotice Receipt For OKEECHOBEE County.

Ad Valorem Tax Exemption Application and Return Not-For-Profit Sewer and Water Company and Not-For-Profit Water and Wastewater Systems N. What is the Ad Valorem Tax. The property appraisers office and the tax.

The Board of County Commissioners School Board City Commissioners and other tax levying bodies set the millage rate which is the rate of tax per one thousand dollars of taxable value. Exemptions for Homestead Disability Widows and Agricultural Classifications are also determined by the Property Appraisers office. 3 if paid in December.

Under Georgia law the owner as of January 1st is the person responsible for filing the return with respect the property 3 Ga. The Real Estate and Tangible Personal Property tax rolls are prepared by the Property Appraisers office. Real Estate Finance Foreclosure.

These tax statements are mailed out on or before November 1st of each year with the following discounts in effect for early payment. 1121 sections 1962001 and 1962002 FS PDF 116 KB. Ad Valorem means based on value Ad Valorem Taxes are based on the value of real estate or tangible property determined by the Property Appraiser.

The Property Tax Oversight PTO program publishes the Florida Ad Valorem Valuation and Tax Data Book twice. Take the tax rate of 2450 and move the decimal point three places to the left to multiply the entire assessed value. Taxes on all real estate and other non-ad valorem assessments are billed collected and distributed by the Tax Collector.

Non-ad valorem assessments are determined. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Notice Of AD Valorem Taxes Non-AD Valorem Assessments.

The tax year runs from January 1st to December 31st. 2 if paid in January. Ad Valorem Tax Exemption Application and Return For Nonprofit Homes for the Aged R.

Tax bills are mailed on or around November 1 each year and discount periods allow you to save money by paying early. The Florida Constitution reserves ad valorem taxation to local governments and prohibits the state from levying ad valorem taxes on real and tangible personal property1 Ad valorem taxes are annual taxes levied by counties cities school districts and certain special districts.

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

How To Read Your Property Tax Bill O Connor Property Tax Reduction Experts Property Tax Tax Tax Reduction

How School Funding S Reliance On Property Taxes Fails Children Npr

Property Taxes Brevard County Tax Collector

What Is A Homestead Exemption And How Does It Work Lendingtree

Pin By Bartley Realty On Real Estate Tips Home Ownership Buying First Home Real Estate Infographic

Property Tax Exemptions Available In Florida Kin Insurance

Florida Property Tax H R Block

Secured Property Taxes Treasurer Tax Collector

The Hidden Costs Of Owning A Home

Florida Dept Of Revenue Property Tax Data Portal

Florida County Property Appraiser Search Parcel Maps And Data

Florida Property Tax Consulting Property Tax Tax Payment Tax Consulting

Florida Dept Of Revenue Property Tax Data Portal

Property Tax Exemptions In Florida Kim Devlin Kim Devlin In 2022 Property Tax Tax Exemption Property

/6355404323_7ec7219643_k-035f3f9902fe47db8ef2f2ff7cf82738.jpg)